ENSURING A ROBUST BUSINESS MODEL

OUR CAPITAL

-

FINANCIAL

-

PORTFOLIO

-

INTELLECTUAL

-

HUMAN

-

SOCIAL AND

RELATIONSHIP

-

NATURAL

OUTPUTS

OUTCOMES

TRADE-OFFS

Our Competitive Advantages

01

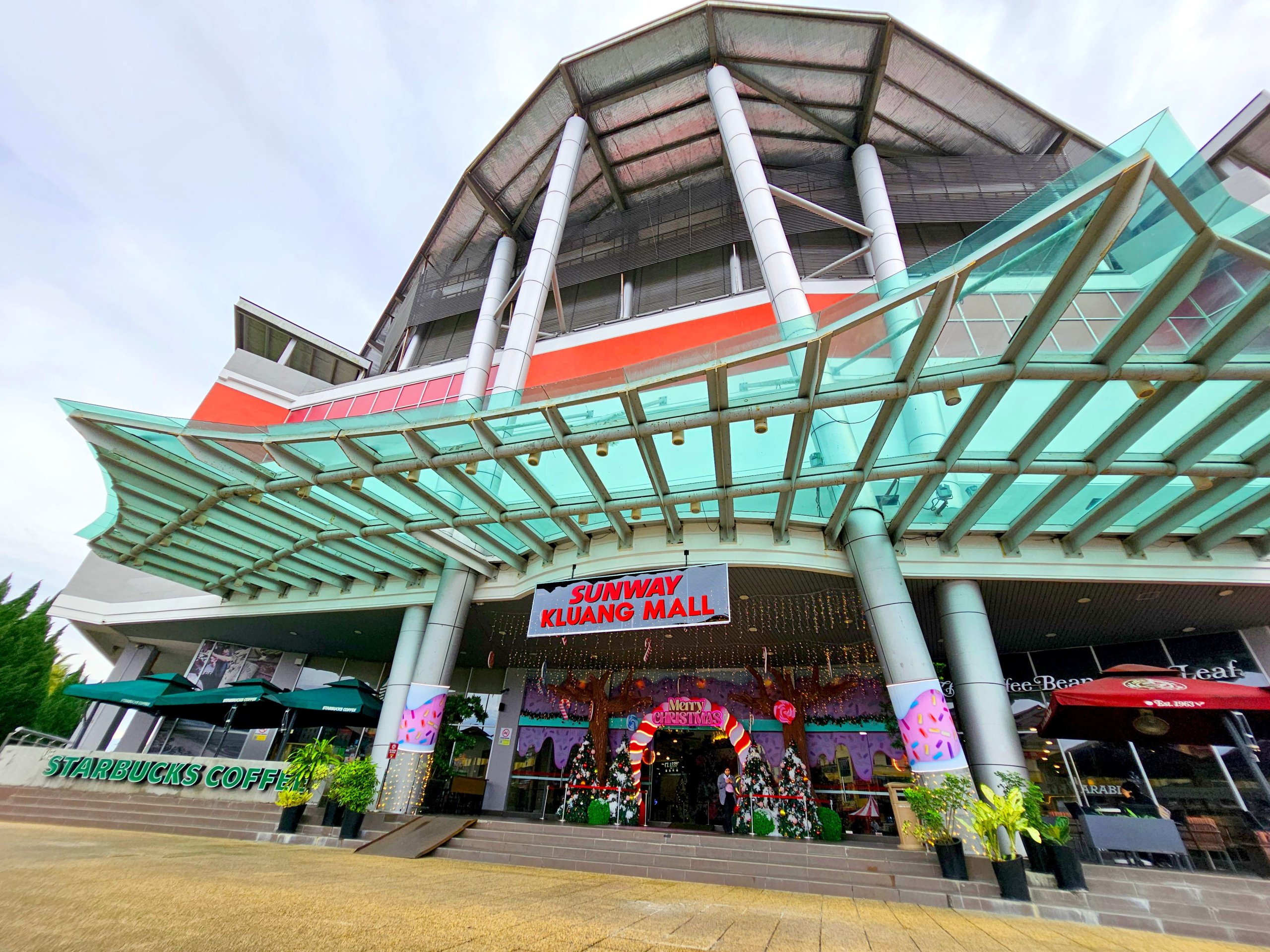

Diversified

Asset

Portfolio

02

Prudent Risk

Management

03

Experienced

and Diverse

Backgrounds

& Skill Sets

04

Strong

Relationship

with Tenants

05

Sunway

Brand

Synergy

06

Responsible

& Sustainable

Business

Practices

07

Performance

Track

Record

08

Progressive

Mindset &

Innovative

Processes