ABOUT SUNWAY REIT

Sunway Real Estate Investment Trust (Sunway REIT) has a distinctive portfolio and is one of the largest diversified real estate investment trusts (REITs) in Malaysia with assets that are strategically located across award-winning integrated townships in key locations within Klang Valley, Penang and Perak.

Sunway Real Estate Investment Trust (Sunway REIT or Trust) is one of the largest diversified Real Estate Investment Trusts (REITs) in Malaysia, with a diverse portfolio strategically located across award-winning integrated townships in key locations in Greater Kuala Lumpur, Penang, and Perak.

Sunway REIT was listed on the Main Market of Bursa Malaysia Securities Berhad (Bursa Malaysia) on 8 July 2010. The market capitalisation of Sunway REIT stood at RM5.3 billion as at 31 December 2023.

Sunway REIT owns a diversified portfolio of 19 properties comprising 5 retail properties (including a property designated for re-development into a retail-centric tourist destination), 6 hotels, 5 offices, an education property and two industrial properties, with a combined property value of RM9.0 billion as at 31 December 2023.

Sunway REIT’s properties are primarily in Sunway City where its flagship retail property, Sunway Pyramid Mall, is located. Other properties in Sunway City include Sunway Resort Hotel, Sunway Pyramid Hotel, Sunway Lagoon Hotel, Menara Sunway, Sunway Pinnacle and Sunway university & college campus.

Sunway REIT owns four properties in Kuala Lumpur, namely Sunway Tower, and three remaining assets that constitute part of the 3-in-1 integrated development, Sunway Putra. Sunway Putra consists of Sunway Putra Mall, Sunway Putra Hotel and Sunway Putra Tower.

Sunway REIT also owns four properties in Selangor, namely Wisma Sunway, Sunway REIT Industrial – Shah Alam 1, Sunway REIT Industrial – Petaling Jaya 1 and Sunway Pier.

In the northern region, Sunway REIT owns SunCity Ipoh Hypermarket in Perak, as well as Sunway Hotel Seberang Jaya, Sunway Hotel Georgetown and Sunway Carnival Mall in Penang.

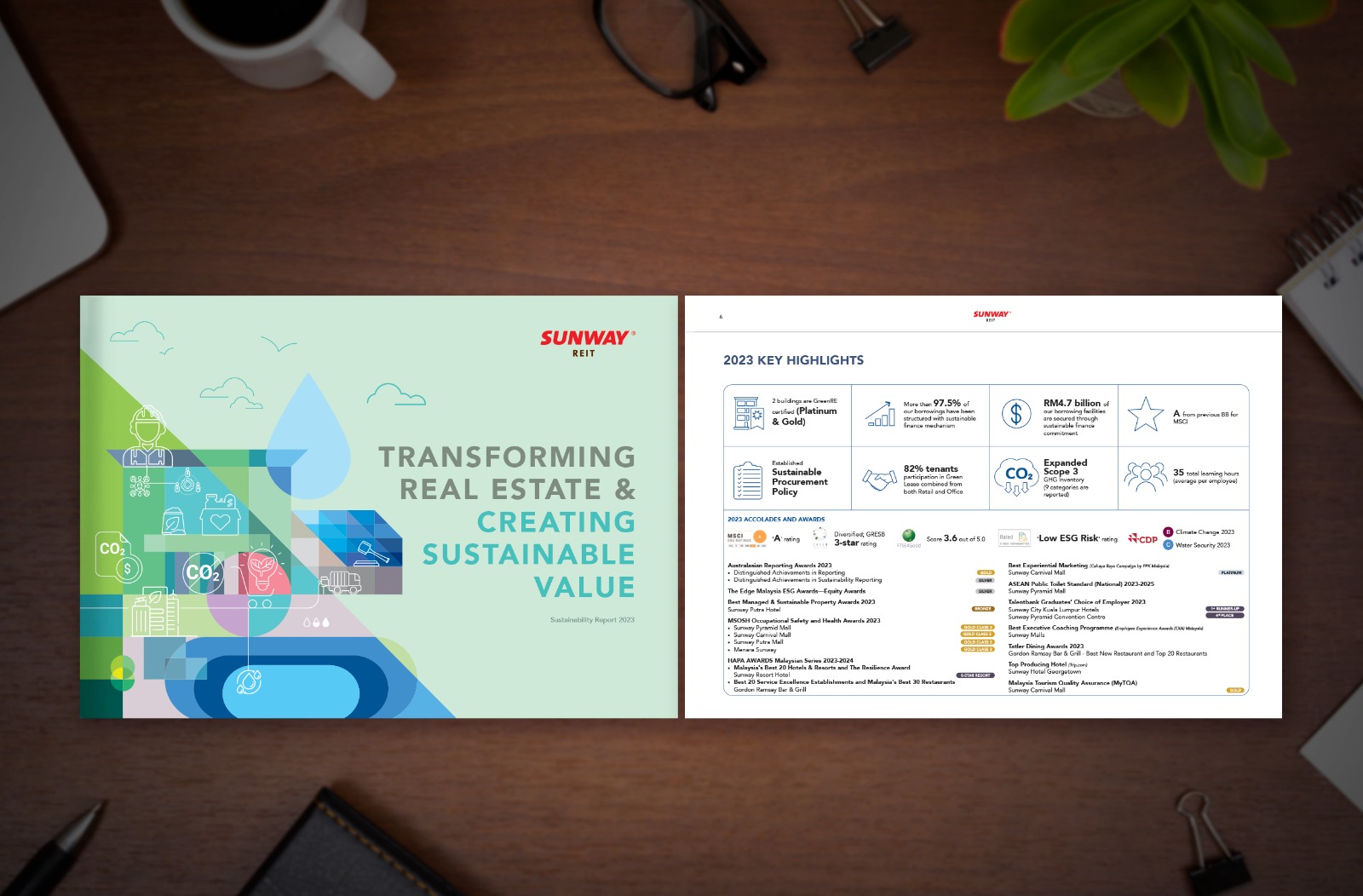

KEY HIGHLIGHTS FY2023

PROPERTY

VALUE

GROSS

FLOOR AREA

GROSS

REVENUE

NET PROPERTY

INCOME

DISTRIBUTION

PER UNIT

MARKET

CAPITALISATION

NO. OF

ASSETS

DISTRIBUTION

YIELD

Sunway REIT'S acquisition From 2010 - 2022

July 2010 (IPO)

July 2010

Initial Portfolio of 8 Assets

-

Retail Mall, Hotel, Office – Sunway City Selangor

Office – Kuala Lumpur

Retail Mall, Hotel – Seberang Jaya, Penang

Hypermarket – Ipoh, Perak

- 2010

April 2011 (IPO)

April 2011

Sunway Putra

-

Integrated Development – Kuala Lumpur

- 2011

December 2012 (IPO)

December 2012

Sunway Medical Centre

(Tower A & B)

-

Medical Centre – Sunway City, Selangor

- 2012

January 2015 (IPO)

January 2015

Sunway Hotel Georgetown

-

Hotel – Georgetown, Penang

- 2015

March 2015 (IPO)

March 2015

Wisma Sunway

-

Office – Shah Alam, Selangor

- 2015

December 2016 (IPO)

December 2016

Commercial Land for Expansion

of Sunway Carnival Shopping Mall

-

Vacant Land – Seberang Jaya, Penang

- 2016

August 2017 (IPO)

August 2017

Sunway REIT Industrial

– Shah Alam 1

-

Industrial – Shah Alam, Selangor

- 2017

February 2018 (IPO)

February 2018

Sunway Lagoon Hotel

-

Integrated Development – Sunway City,

Selangor

- 2018

April 2019 (IPO)

April 2019

Sunway university

& college campus

-

Education – Sunway City, Selangor

- 2019

November 2020 (IPO)

November 2020

The Pinnacle Sunway

-

Office – Sunway City, Selangor

- 2020

January 2022 (IPO)

January 2022

Retail – Port Klang, Selangor

-

Sunway Pier

- 2022

November 2022 (IPO)

November 2022

Industrial – Petaling Jaya, Selangor

-

Sunway REIT Industrial – Petaling Jaya 1

- 2022

TRANSCENDING TOWARDS SUSTAINABLE GROWTH

-

Our Value Creation ModelOur Value Creation Model

MISSION

To deliver sustainable income distribution over the long-term through responsible business strategies supported by adaptive innovation solutions, management and sustainability practices

VISION

To be a leading diversified REIT in Malaysia committed to enhancing stakeholder value – Sustainable Growth, Environmental Stewardship and Community Engagement

Purpose

- Empowering businesses

- Curating experiences

- Enriching lives

CORE VALUES

- Integrity

- Humility

- Excellence

Good Governance

-

Our StructureOur Structure

-

Our Corporate GovernanceOur Corporate Governance

-

Our Board of Directors & Management TeamOur Board of Directors & Management Team